In Warren Buffet’s first letter to his shareholders he wrote that a good investor should realize “the importance of being in businesses where tailwinds prevail rather than headwinds.” The context here was the textile mills he owned which were excellently managed yet struggling to return a profit, compared to the insurance businesses he owned whose management had made some mistakes yet still scored fantastic returns.

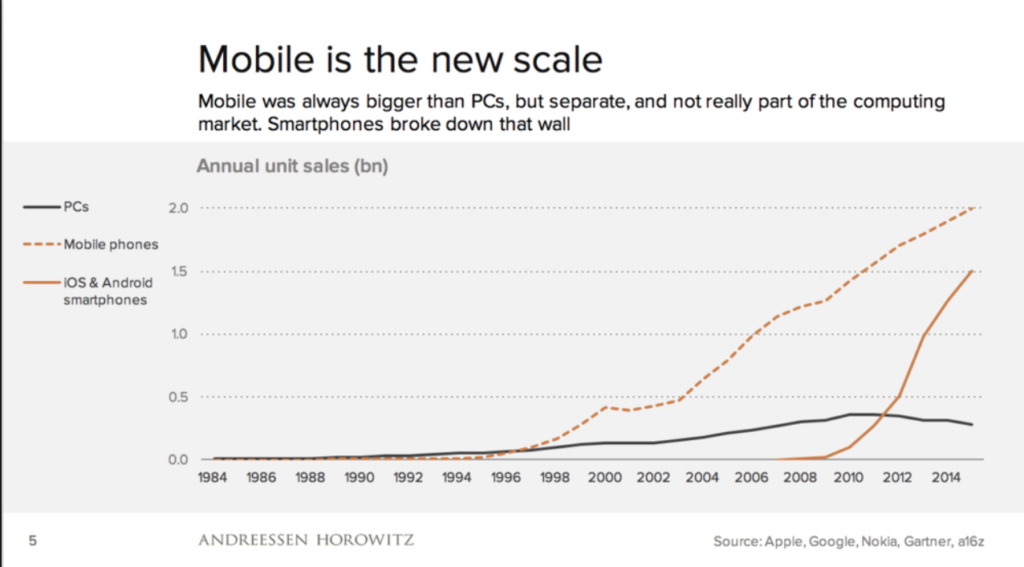

I’ve tried to pay attention to tailwinds throughout my career, and have inserted myself into businesses and roles where I’d have the flexibility to take risks without much concern of sinking. First it was microfinance, then mobile money, then mobile app development, and finally financial services and banking technology. These were all areas that at the time received more funding than other sectors and attracted better talent. That allowed me to expand into new markets faster and work with incredible people. All of these sectors were smaller breezes compared to the tailwind that pushed these all all forward; mobile phone penetration.

The tailwind that is mobile continues now and will continue for the next 10-15 years, before the next paradigm shift to embedded technology. At this time, I believe the best tech entrepreneurs and executives think mobile first. I believe investing in and working for mobile first businesses is still the best bet for your career, and I believe there’s still lots more innovation to go in mobile devices. This is a tailwind I plan on staying in.