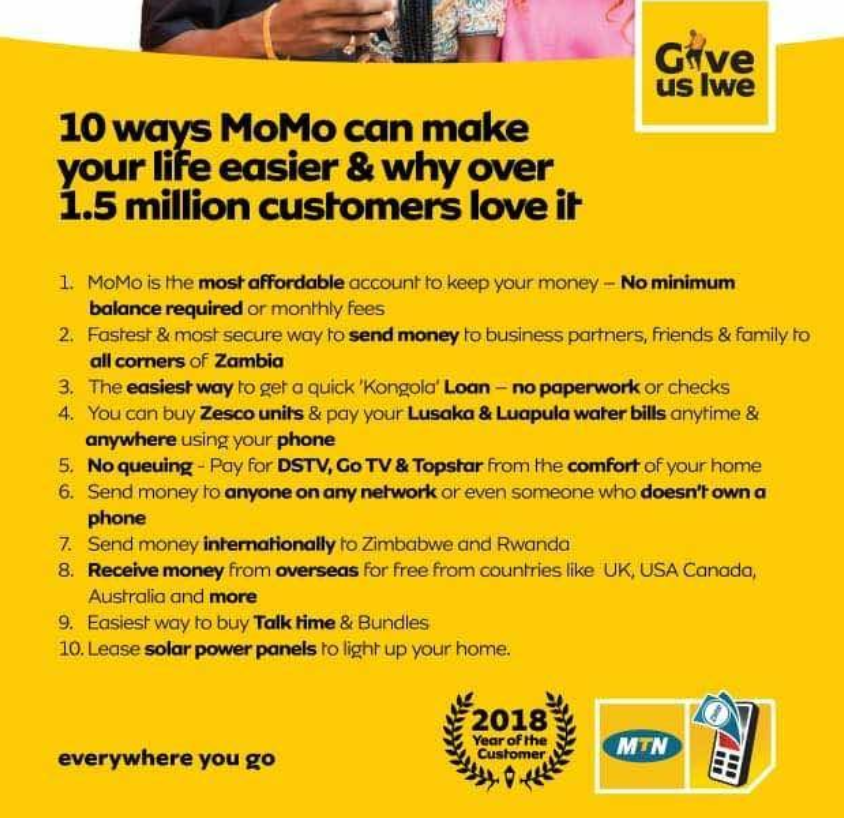

I’m a big fan of fintech. It’s awesome. It’s where I hope to spend my career. There’s innovation occurring across the sector, from different stores of value to entirely new means of exchange. I’ve focused the better half of the last 9 years focusing on fintech in Africa. The major drive here has been on financial inclusion; building applications and platforms that give African people access to financial choice. That’s a big hairy ambitious goal. And it’s great to be a part of it. But what does fintech in Africa actually mean? What kind of products are being created, and what are the use cases for customers? I’ll focus on different types of products in a later post, but below is an example of ten use cases for customers. These are use cases for MTN Zambia’s mobile money service.

By signing up for a mobile money service a customer gets all the benefits of a bank account, plus more, and at a lower cost. Signing up for an account only requires an ID, and the customer immediately gets access to a variety of services. Mobile money is transforming the financial landscape in Zambia. After years of resistance, traditional banks are now clamouring to get involved. Startups are setting up shop, and the MNOs are now the nouveau rich of tech. It’s a fascinating landscape, with benefits accruing to all parties, but especially the customer. It’s still early days too, which means that these ten use cases will soon become 100. Cool.