If the number of credit providers in a country was a reliable heuristic for identifying a credit bubble, you would say that yes, Kenya is in a credit bubble. However, that is unfair since while it might be a reliable metric, by no means is it the only one. So the title of this blog was a bit misleading because I can’t answer it. This isn’t the type of blog that pours over statistics to give you the insight you need to short Kenyan bonds in the Euromarket. No, it’s a simple blog, one of mostly bad casual observations. But I digress.

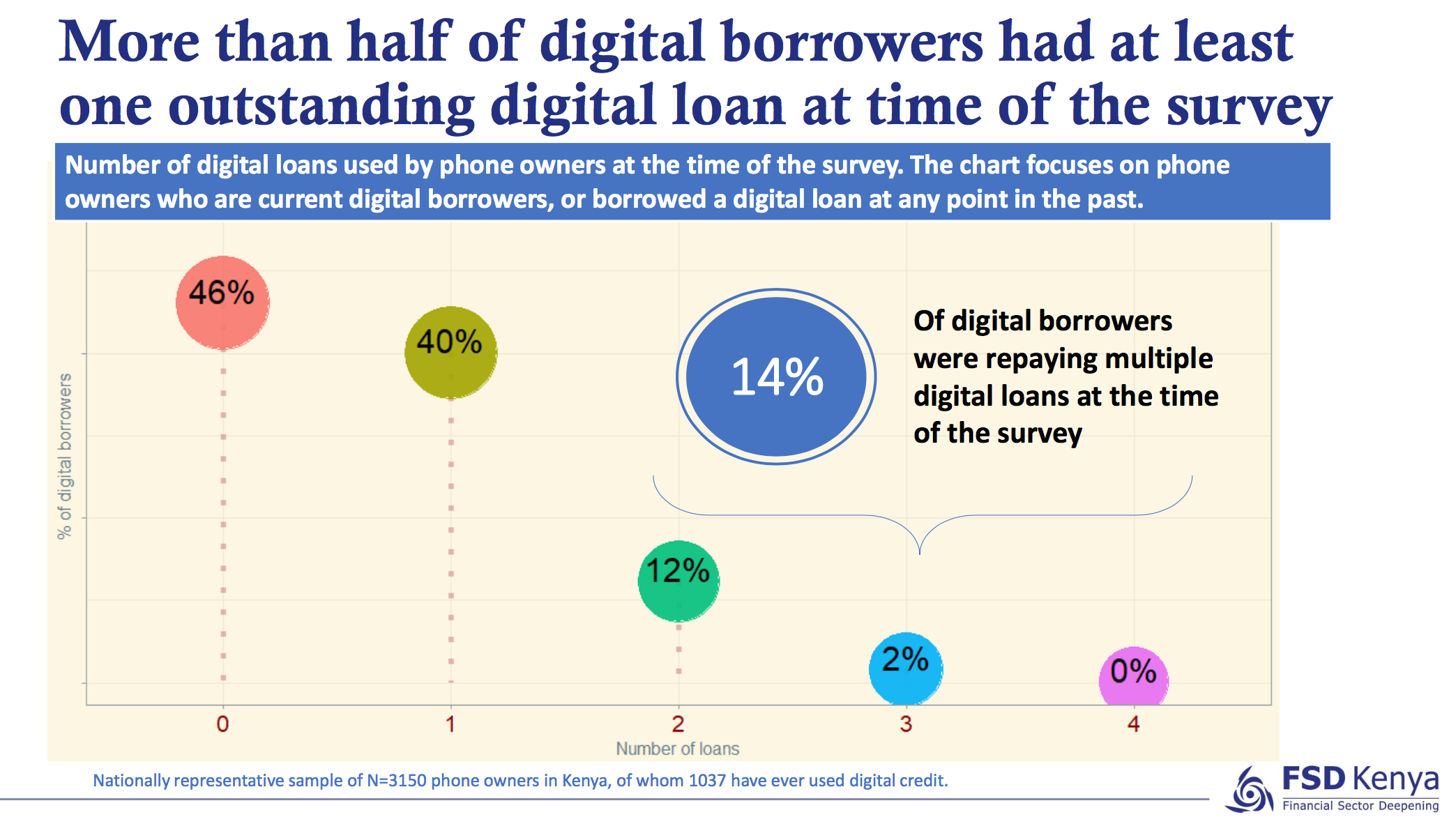

What I do know is that the Kenyan digital credit ecosystem is frothy. Over Easter, I talked to a friend who runs a microfinance company in Kenya, and he estimates that there are around 50 digital lenders in Kenya now. The last official figure I could find was 20, and that was in 2016. Digital borrowing is by nature incredibly easy to access. Customers often qualify for nothing more than giving up some privacy settings on their phone, or because they use other services on their feature phone. Couple this with the fact that credit businesses want to grow their loan book, and you get a dangerous combination. I’m not saying it’s a serious problem right now, but there are concerning signs. Finally, digital lenders don’t have a central database of customer information. Each lender is racing to know the most about their customers while acquiring the most customers. Look at the graph below.

Does this mean we should pull the handbrake on digital lending? Is Kenya in a credit bubble? I think the answer to both of those questions is no right now. The loan sizes in digital lending are small, and the lenders are getting better at assessing credit risk. The Bank of Kenya is also a champion of the little guy. But lenders in Kenya must pay attention to the warning signs, and make an effort to look at their blind spots. No one wants a credit bubble.