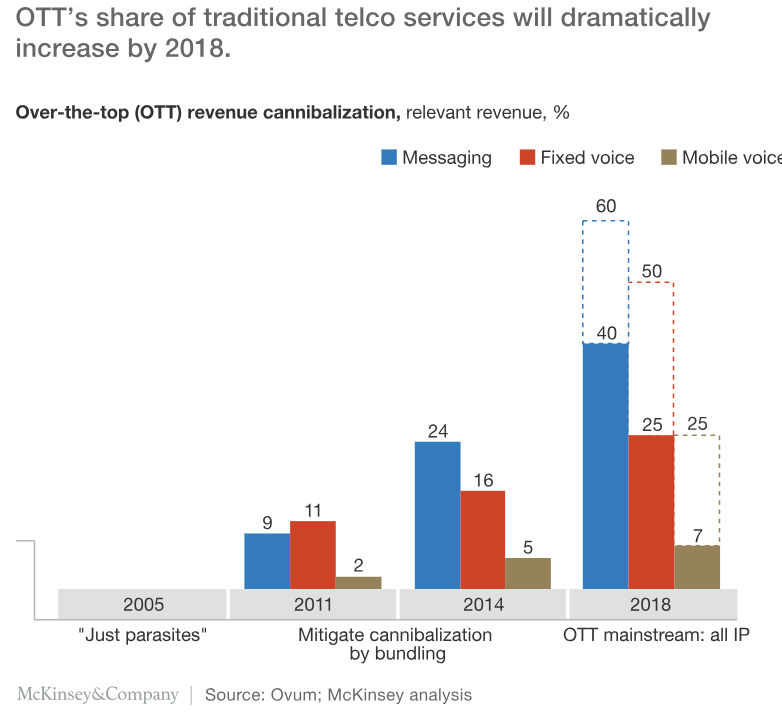

Telco operators (MNOs) across Africa are experiencing declining revenues in their core businesses. Generally, in the past seven years, OTT players have taken up to 40% of the market in messaging, 25% in fixed voice, and 7% in mobile voice. In Africa, I’m willing to bet that’s 50%-75% higher for smartphone users.

When I moved to the continent ten years ago BBM was the data messenger of choice. At that point, the MNOs had a firm grasp on Blackberry distribution as well, often requiring hefty postpaid contracts to qualify for a blackberry. Then, as data penetration grew and data prices started dropping, new better messaging solutions appeared. Messenger, WhatsApp, and

Over my first 5 years in

There’s another revenue vertical in Africa that I think will be unbundled soon. That is payments. When I think about M-Pesa it’s clear to me how successful they’ve been but also how arrogant they’ve become. They’ve disintermediated the banks and now account for over 20% of Safaricom’s revenue. But what’s their moat? There’s the distribution network, with physical points managed by franchises, but that is eroding. That erosion won’t be quick, but it will happen. Banks will swing back hard with credit cards and digital payments. New payment systems might move in, and even cryptocurrencies will have an impact. Then there’s the technology itself, which isn’t much of a moat.